Asia Pacific Energy Regulatory Forum

On August 1-2, 2012, the Asia Pacific Energy Regulatory (APER) Forum took place at the Federal Energy Regulatory Commission office. This meeting was the third of its kind, convening energy regulators from North America and the Asia-Pacific region together to share experiences and best practices for energy regulation. Discussion ranged from an overview of regulatory frameworks, grid reliability, integration of renewable resources to existing and future electricity networks, oil and gas pipeline regulation, carbon trading and competition within energy markets. Among the most notable speakers were FERC Chairman Jon Wellinghoff (US), FERC Commissioners Philip D. Moeller (US) and John R. Norris (US), Natural Resources Canada Director John Foran, Energy, Environment Division Head Brendan Morling (Australia), State Electricity Regulatory Commission Director-General Yiqiao Zou (China), Electricity Authority Chief Executive Carl Hansen (New Zealand), Energy Market Authority Chief Executive Hong Tat Chee (Singapore), Central Electricity Regulatory Commission Chairperson Pramod Deo (India) and Energy Regulatory Commission Chairman Direk Lavansiri (Thailand).

Renewables in New Markets

In Ontario, Canada, renewable energy has experienced significant growth in electricity markets due to their provincial government’s enactment of supportive policies. Darren Finkbeiner from Ontario’s Independent Electricity System Operator discussed how the province’s network operator is managing this integration of new variable resources.

By 2014, Ontario has decided to retire 6,500 MW of coal while adding 10,700 MW of intermittent renewables, mostly in wind and solar. Ontario is counterbalancing the retired coal by adding more than 10,000 MW of natural gas-fired power generation, a dispatchable resource, to allow for greater flexibility and network stability. To guarantee visibility of large-scale embedded solar and wind generators, reporting and direct telemetry will be implemented by IESO. In addition, to resolve surplus baseload generation, ramping and transmission constraints, economic dispatch integration is necessary. By 2014, Ontario hopes to fully implement a centralized forecasting system for solar and wind.

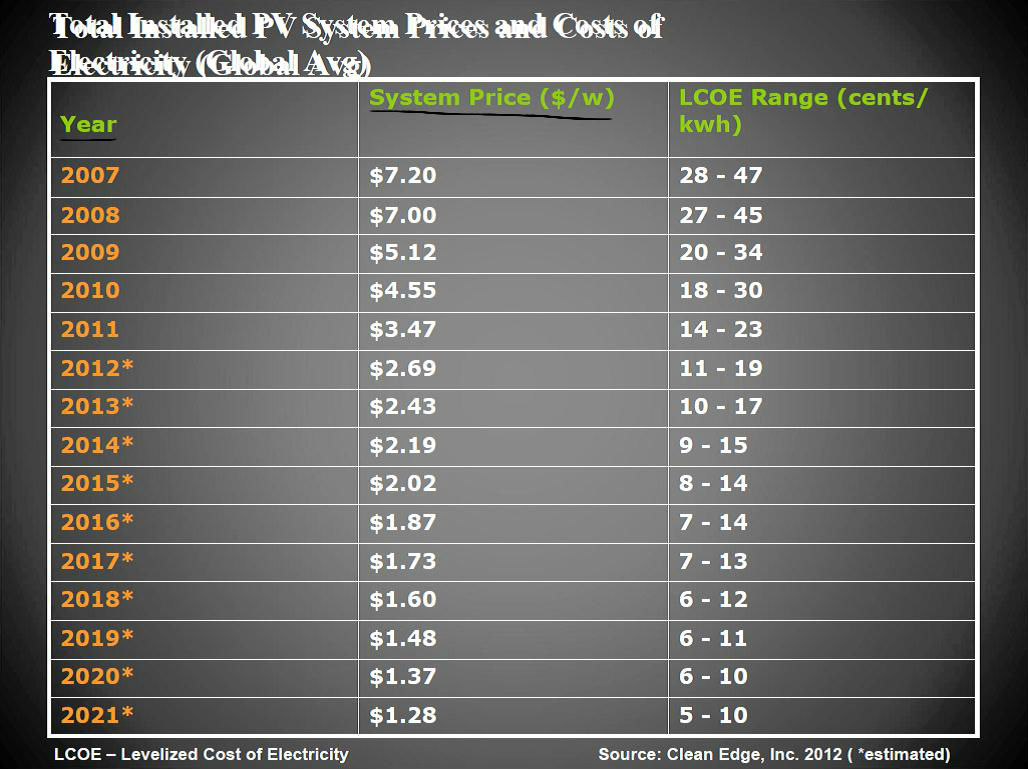

From an American perspective, FERC Chairman Jon Wellinghoff spoke about the incremental decrease in photo-voltaic system cost and price of electricity. Since 2007, the price per watt of installed solar PV has decreased by over 60% to $2.69/watt. In addition, the levelized cost of electricity (LCOE) range per watt of solar PV has gone from $28-47 in 2007 to $11-19 in 2012. Experts expect this downward price trend to continue until solar PV reaches widespread grid parity.

Chairman Wellinghoff also cited technology advancements that he expects will further drive the adoption renewable energy technology. MIT students are working on a transparent solar panel to harness energy from its convenient placement on house windows. Significant gains are also occurring in the field of energy storage, although the cost remains prohibitively high at present. Stationary batteries, water heaters, compressed air storage and electric vehicles could play an important role in energy storage, as well as in providing ancillary services to the electric grid.

Impact of Competition in Supply

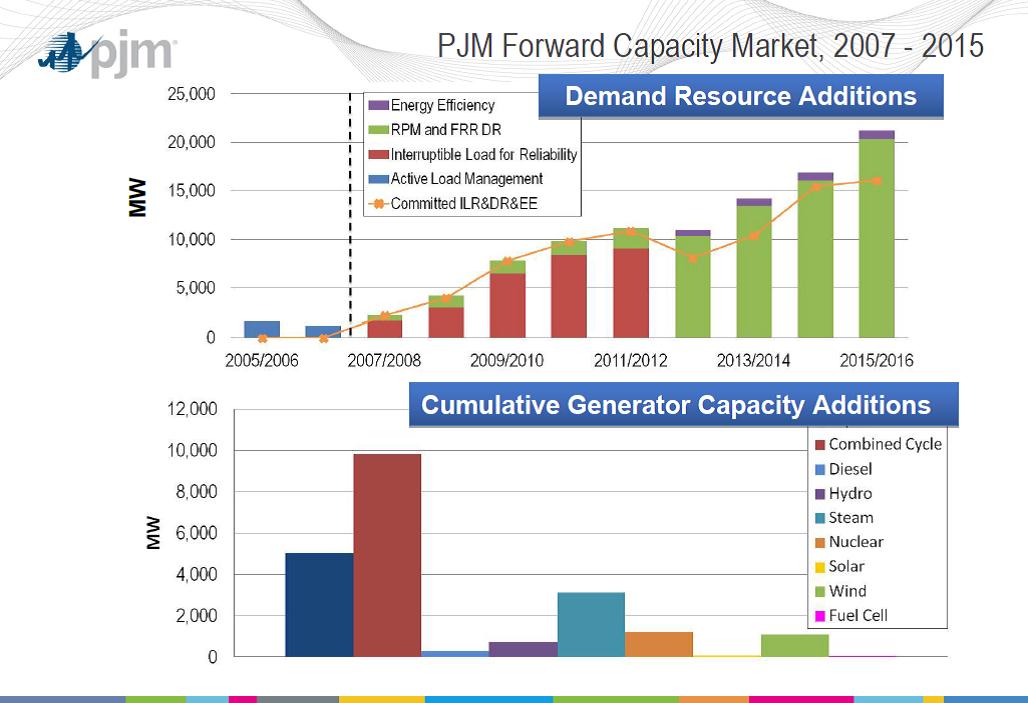

Andrew L. Ott, the Senior Vice President for markets at PJM Interconnection, spoke directly about the impact of competition on electricity supply. As the largest competitive wholesale electricity company in the world, PJM manages grid services over the Eastern Interconnection of the United States. PJM has come up with innovative ways to incentivize ancillary services that optimize network efficiency and produce high-quality power for customers. In doing so, untraditional players have come into the market in order to provide PJM with ancillary services, such as demand response, frequency support and additional power resources, during times of constrained electric supply.

Transitioning to a Low-Carbon Economy

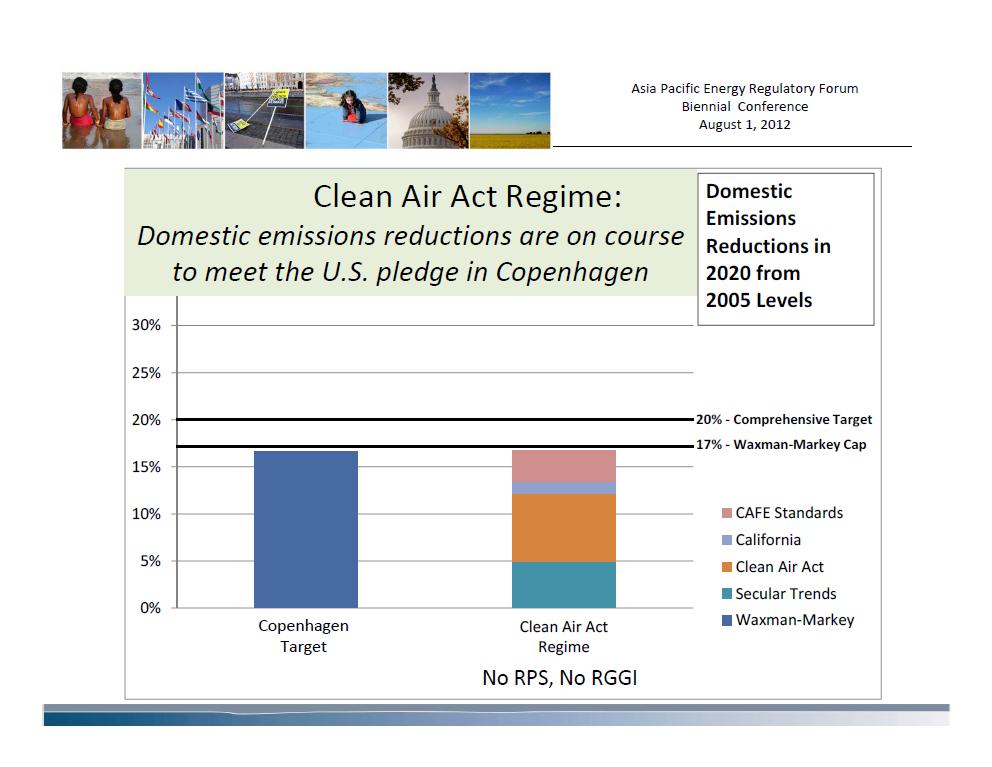

Energy officials and regulators are trying to find ways to foster a transition to a low-carbon economy. Dallas Burtraw, Senior Fellow and Darius Gaskins Chair at Resources for the Future (RFF), spoke about the steps the United States is taking to encourage the adoption and integration of clean power technologies in America. As coal-fired power generation emits one-third of all the carbon emissions in the United States, many coal plants have been targeted for retirement and replaced by cleaner-burning natural gas and renewable energy. California has been leading the charge in implementing policies that encourage the development of a low-carbon power sector by eliminating coal from future new-build power sources and increasing the states renewable portfolio standard to 33% by 2020. The California-based utility PG&E is hoping that 40% of its renewable portfolio will be composed of solar PV, 23% wind, and the remainder from hydrothermal, geothermal and distributed solar PV. It is not only certain states that are trying to reduce carbon emissions, but the U.S. government as a whole. Under the Clean Air Act, the EPA has issued improved vehicle emission standards by 5% each year, moving from 35.5 mpg fleet average in 2016 to 54.5 mpg by 2025.

Oil and Gas Developments

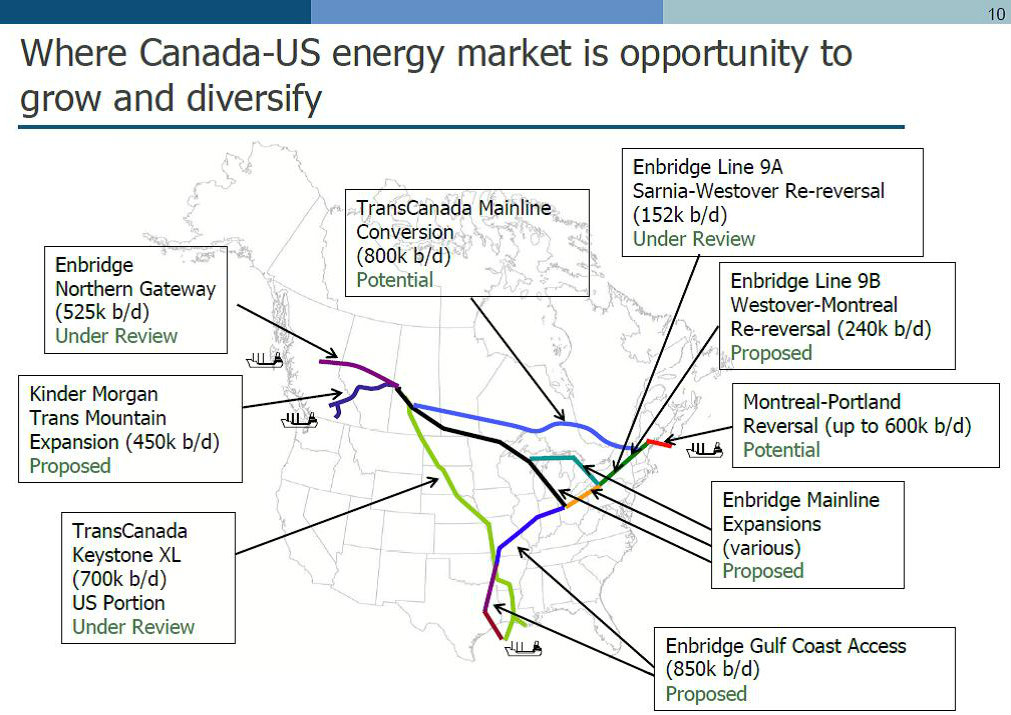

Over the next few decades, energy demands will only continue rising. Between 2010 and 2035, global demand will increase by one-third, mainly from the modernization of underdeveloped countries. India and China are expected to account for 50% of growth. Because of this, fossil fuels, like oil and gas, will still account for 80% of supply by 2035. Canada will be at the forefront of this journey forward due to their abundance of fossil fuels. John Foran, Director of Natural Resources Canada, spoke about these issues. America’s neighbor to the north has the third largest oil reserves, after Saudi Arabia and Venezuela. To successfully continue tapping their reserves, Canada will need to invest in new infrastructure that is expected to cost $294 billion. Markets need to be adjusted to provide sufficient demand over the medium-term. Although America has enjoyed being Canada’s largest customer (98% of exports go to the U.S.), the increasing demand for energy is causing Canada to look towards China and other Asian countries for new markets.

Nonetheless, Canada is still committed to responsible stewardship of their natural resources. Carbon emissions are expected to decrease by 17% between 2005 and 2020, and they are continuing to diversify their renewable resource base as well.